U.S. billionaires reach record new levels of wealth study finds

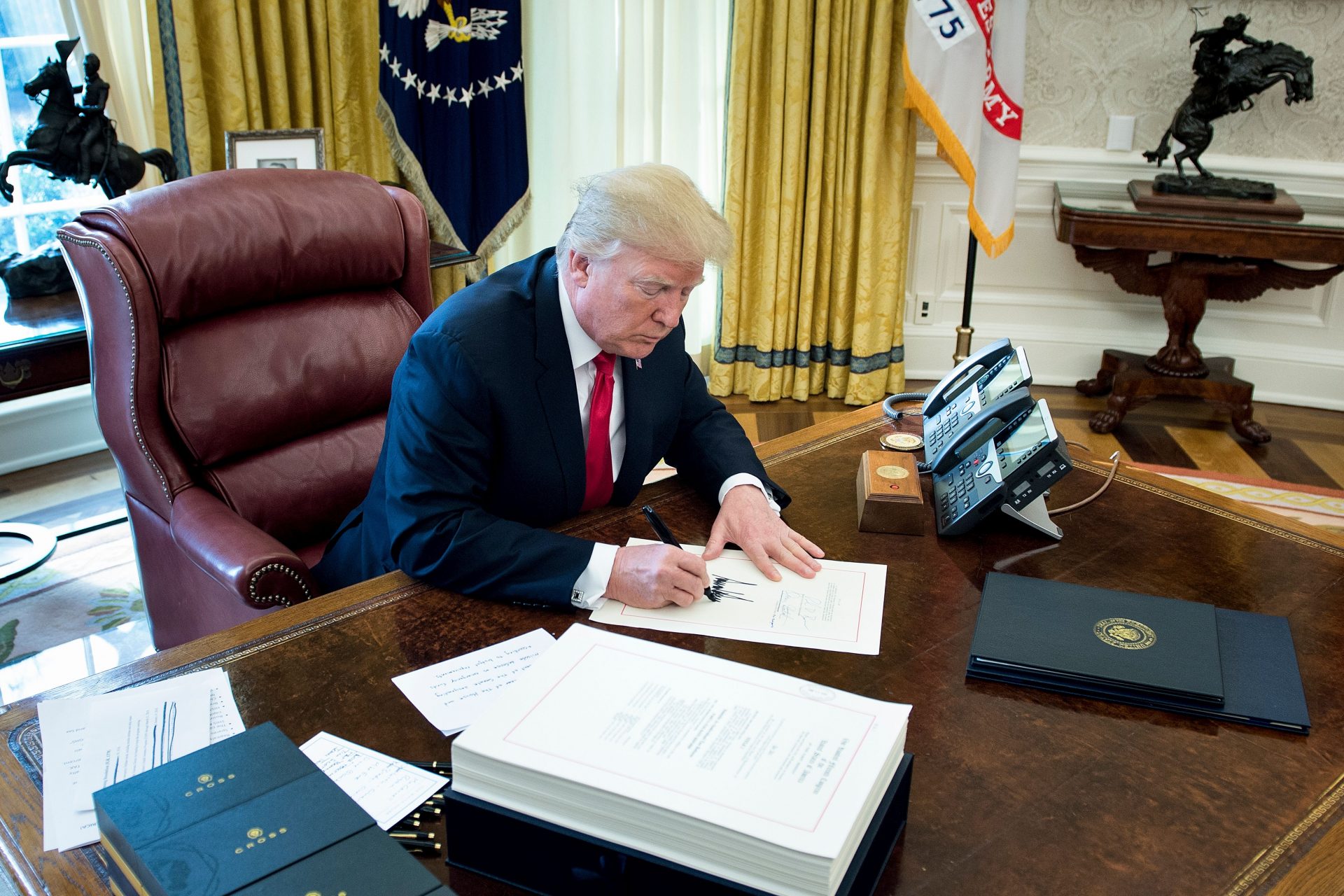

The richest billionaires in the United States have gotten a lot wealthier thanks to Donald Trump and his 2017 tax cuts. A new study showed the collective wealth of billionaires in America has reached a new record high.

Using data from Forbes, Americans for Tax Fairness found that the collective fortune of the 806 billionaires in the United States hit a new record of $5.8 trillion. That number is difficult to comprehend, but it's enormous.

One of the easiest ways to understand just how much wealth billionaires now control is by looking at it in relation to the total wealth of the country. Billionaires control about one in every twenty-five dollars of U.S. wealth.

Billionaire wealth is up by $2.9 trillion since Trump enacted his 2017 tax cuts, and under the current laws in the United States, it is unlikely that any of that wealth growth is going to be taxed. Americans for Tax Fairness explained why.

“As working Americans hustle to meet the annual tax-filing deadline... most would be shocked to find that the recent stupendous growth in billionaire wealth may never be taxed,” the Americans for Tax Fairness report read.

According to the report, under current law capital gains are only taxed when an asset has been sold. However, wealthy Americans get capital gains taxes by never selling their assets and instead borrowing money at low-interest rates to fund their lifestyles.

The ten wealthiest men in America have seen their wealth increase faster than their rich peers. In less than six years the top ten billionaires in the United States saw their wealth rise by 153% compared to their other billionaire peers.

The top twenty-five billionaires in the country are now worth $2.3 trillion collectively. This is a figure that Americans for Tax Fairness explained was as much as the total net worth of all U.S. billionaires just a decade ago.

The Executive Director of Americans for Tax Fairness David Kass said in a statement that the doubling of billionaire wealth in under six years was a signal the resources of the country were only flowing towards the super-wealthy.

“The last thing we need to do now is permanently extend the Trump tax cuts for the wealthy that are due to expire at the end of next year,” Kass explained, referring to the upcoming battle Washington will see over extending Trump’s 2017 tax cuts.

“Permanent extension of high-end tax cuts would cost trillions of dollars we could invest in working families and communities and would worsen the nation’s economic inequality that the latest billionaire figures so prominently highlight,” Kass added.

Washington is set for a battle over what to do about the former prescient tax cuts since several consequential provisions of the Tax Cuts and Jobs Act are set to expire in 2025, including a cut to the top income tax rate and the two-fifths cut in the corporate tax rate.

“Corporate tax cuts are almost synonymous with tax cuts for the wealthy because it’s overwhelmingly rich people–prominently including billionaires–who own corporations through their stock holdings,” the Americans for Tax Fairness report read.

The report went on to claim that if the country was able to tap into the nearly $500 billion dollars in yearly billionaire gains over the last nearly six years at the top capital gains tax rate of 23.8 percent, then the government could bring in $120 billion annually.

In March 2024, the Center on Budget and Policy Priorities reported that the Trump tax cuts skewed toward the rich were expensive for the country, and failed to deliver on the economic benefits made by the Trump Administration.

Trump’s tax cuts gave roughly $60,000 in cuts to America's wealthiest and about $500 to the bottom 60% of households, they will cost the U.S. $1.9 trillion over ten years, and workers who earned less than $114,000 on average saw “no change in earnings.”

More for you

Top Stories