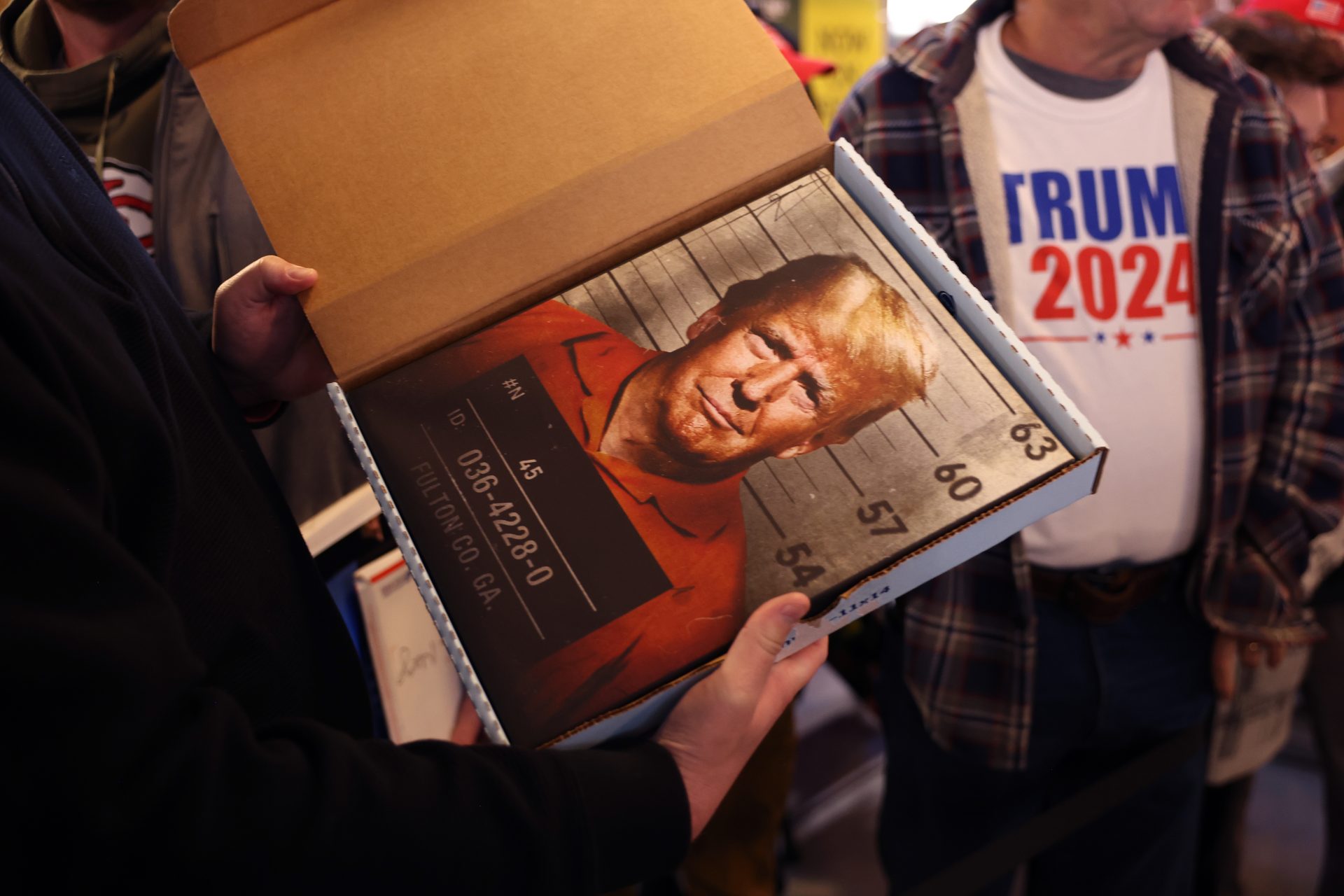

Trump may soon be facing a new big legal problem

A leading political watchdog and non-profit organization working to bring both ethics and accountability back to Washington has asked the Federal Bureau of Investigation (FBI) to look into Donald Trump for possibly violating another law.

The former president is already facing eighty-eight state and federal charges connected to his various alleged crimes but Trump may soon be adding a new situation to his legal issues if one federal watchdog gets its way.

Citizens for Responsibility and Ethics in Washington (CREW) has lodged a formal complaint with the FBI and asked the agency to investigate whether or not the former president made false statements about a loan that violated the law, Law & Crime reported.

According to the watchdog group, Trump may have made false statements by reporting a $50 million loan that he owed to Chicago Unit Acquisitions LLC. The former president did this nine times in his public disclosure reports.

Reporting such a large loan isn’t an issue but the fact that this loan might not have ever existed is a major problem. The existence of the loan was first questioned by Barbra Jones, the special monitor assigned to Trump’s businesses in his civil fraud case.

The Daily Beat reported Jones explained in a letter to Judge Arthur Engoron during the trial that when she questioned the Trump Organization about the loan, she was told it was “between Donald J. Trump, individually, and Chicago Unit Acquisition for $48 million.”

“However, in recent discussions with the Trump Organization, it indicated that it has determined that this loan never existed—and thus that it would be removed from any upcoming forms submitted to the Office of Government Ethics,” Jones added.

Trump’s legal team called Jones' comments “falsehoods” and a “deliberate mischaracterization” of the situation at the time, claiming that the Trump Organization never said the loan wasn’t real according to The Daily Beast’s reporting.

An internal memo regarding what the Trump Organization said about the loan was produced but, as CREW noted in its complaint to the FBI, the memo provided did “not evidence the loan’s prior existence.”

According to the complaint from CREW, the memo only showed that as of December 4th, 2023, the alleged loan between the former president and Chicago Unit Acquisition had “‘no amounts are due or payable’ and ‘no liabilities or obligations are outstanding’”

“It is not clear why Mr. Trump would report a non-existent loan, but the law must be vigorously enforced against office holders and candidates who flout the disclosure process through repeated false statements,” wrote CREW's President Noah Bookbinder.

“Failure to do so not only renders the system meaningless, but, more importantly, undermines the work of ethics officials who must ensure that financial disclosures are accurate so that potential conflicts of interest that present national security risks can be brought to light,” Bookbinder added.

Bookbinder suggested in the complaint from CREW to the FBI that the former president’s allegedly non-existent loan deal “could be part of a tax-avoidance scheme, known as debt parking,” something The Daily Beast has also previously reported.

“Recent disclosures by a court-appointed monitor indicate Mr. Trump may have violated federal law by falsely disclosing a liability owed to one of his own companies on multiple financial disclosure statements he filed between 2015 and 2023,” Bookbinder wrote.

“If Mr. Trump falsified his public financial disclosure statements, he will have undermined the public trust that these laws are designed to protect. An investigation into this matter is important to safeguard that public trust,” Bookbinder concluded.

Whether or not the FBI will look into whether or not the former president wilfully made false statements is not yet known, but the story seems to be picking up more traction as it becomes clear there may be a problem with Trump’s public disclosures.

“Donald Trump has a long history of lying about his finances, but there's a big difference between lying about them in the press and lying about them on a government disclosure," Bookbinder explained in a statement on CREW’s website.

More for you

Top Stories