This is the reason why more companies aren't entering Canada’s grocery market

Food prices in Canada have reached all-time highs in recent years and many in the country are blaming its biggest companies. Canada would seem poised for change in the form of international competitors but many don't want to enter the market. Here's what's been going on.

The years since the global pandemic have seen inflation send the cost of groceries skyrocketing in Canada. The issue has gotten so bad that the federal government has tried to step in and bring outside competition to Canada.

In order to understand the grocery market in Canada, it's important to know that grocery stores are dominated by three major local players—Loblaws, Metro, and Sobeys—and foreign player companies like Walmart and Costco.

In 2022, Canada’s Competition Bureau launched a study on the country’s grocery market and made some very startling conclusions about the sector. The three biggest players in the country were making billions in profits from Canadians.

“Loblaws, Sobeys, and Metro—collectively reported more than $100 billion in sales and earned more than $3.6 billion in profits” in 2022 the Competition Bureau reported, before noting more competition was needed to keep prices in check.

However, the Competition Bureau also reported that it was difficult for independent and regional players to break into the areas where the country’s largest chains operated thousands of stores where shopping habits were entrenched.

The Competition Bureau made four recommendations which all supported the goal of bringing new grocery chains into the Canadian market to foster competition that could help lower grocery prices for Canadians as happened in Australia.

The report noted the opening of more ALDI stores in the Australian grocery market because of its effect on food prices. ALDI caused a “significant reduction in grocery prices when they opened new stores,” according to the Competition Bureau.

“The successful entry of international grocers into the Canadian industry may be the best option to bring about lower prices, greater choice, and increased levels of innovation for the benefit of all Canadians,” the bureau reported.

Officials in Ottawa must have taken note since reports began to emerge in January 2024 that Canadian Minister of Industry Francois-Philippe Champagne was trying to convince foreign grocery companies to enter the Canadian market in a bid to cut down on food inflation.

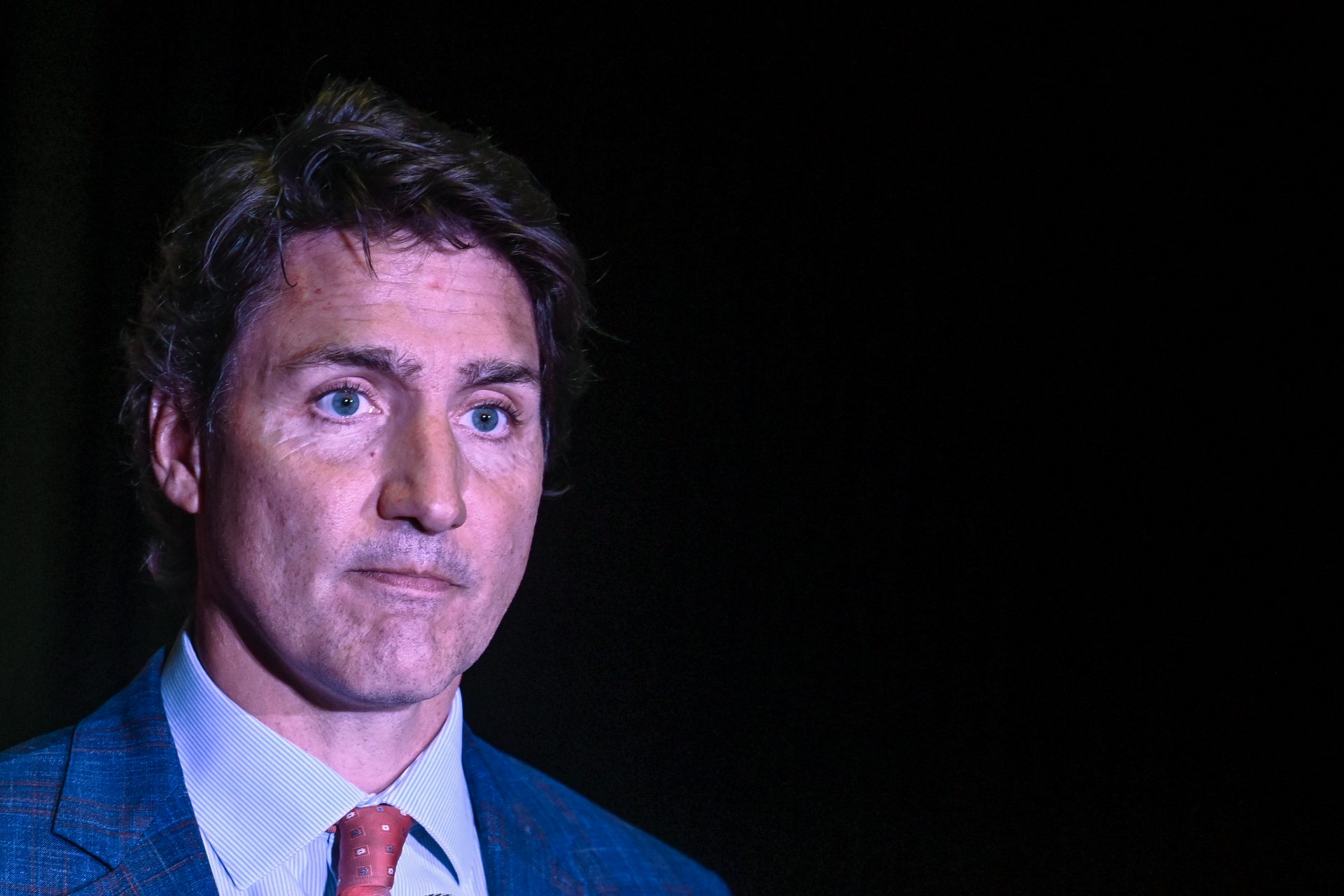

Photo Credit: Wiki Commons By Collision Conf, CC BY 2.0

“I can’t tell you too much, or else you won’t ask me questions next week,” Champagne told reporters in French according to Finacial Post. “I spoke with one company this morning," the minister continued.

The Financial Post also noted that Champagne had met with Canadian grocery companies in the fall of 2023 and demanded that they develop a plan to help reduce food inflation in Canada or else they would face consequences, including a possible taxes.

In April 2024 more reports began to circulate that revealed Canada’s Ministry of Industry had compiled a list of over a dozen different foreign grocery companies it wanted to bring to Canada according to the Wall Street Journal.

Included in those were grocers from Germany, Portugal, and Turkey—though, the report from the Wall Street Journal noted that at least one of the companies on the list already said it would pass on the opportunity to enter Canada’s market.

As the Competition Bureau noted in 2023, entering Canada’s grocery market is difficult for new companies. But what are some of the more in-depth reasons it's challenging for new grocers to enter the Canadian market? One of the big issues is Canada’s size.

Food marketing professor Jordan LeBel of Concordia University told CBC News that the distance in Canada makes opening up business unappealing for grocery companies not already operating in the market.

"Looking at Canada, it's a huge territory. It's a vast land. You have to concentrate your operations around key cities. Is that enough to justify an international expansion?" LeBel said, adding that it would be expensive to set up supply chains across Canada.

Larger grocery companies also have more power when it comes to negotiating with their suppliers for things like fees, packaging, and product placement on shelves, which gives established grocers an edge and allows them to pay less for bulk orders.

"If they're not large scale right away, they're going to pay more for their beef. They're going to pay more for the Heinz Ketchup," Kevin Grier—a grocery market analyst from Guelph, Ontario—told CBC News.

Another big factor hindering new grocery companies from entering the Canadian market is the many requirements and regulations in the country as well as many difficulties in marketing to the different regions of the country like Quebec according to CTV News.

“It’s not a given that just because you open a store and open your door with some products in it that people are going to leave the existing retailer where they shop,” Peter Chapman, founder of the SKUFood consulting firm and a former Loblaw executive.

More for you

Top Stories