Canada is set to become the world’s next nuclear powerhouse

Canada is set to become the world’s next major nuclear superpower, but it isn’t trying to develop nuclear weapons. The friendly nation north of the United States will soon be a big producer of uranium. Maybe the biggest on the planet.

Nuclear power is just one of the many sustainable ways the world is planning to make the transition away from fossil fuels and the dangerous emissions they produce, which means that uranium is going to be an even bigger key commodity.

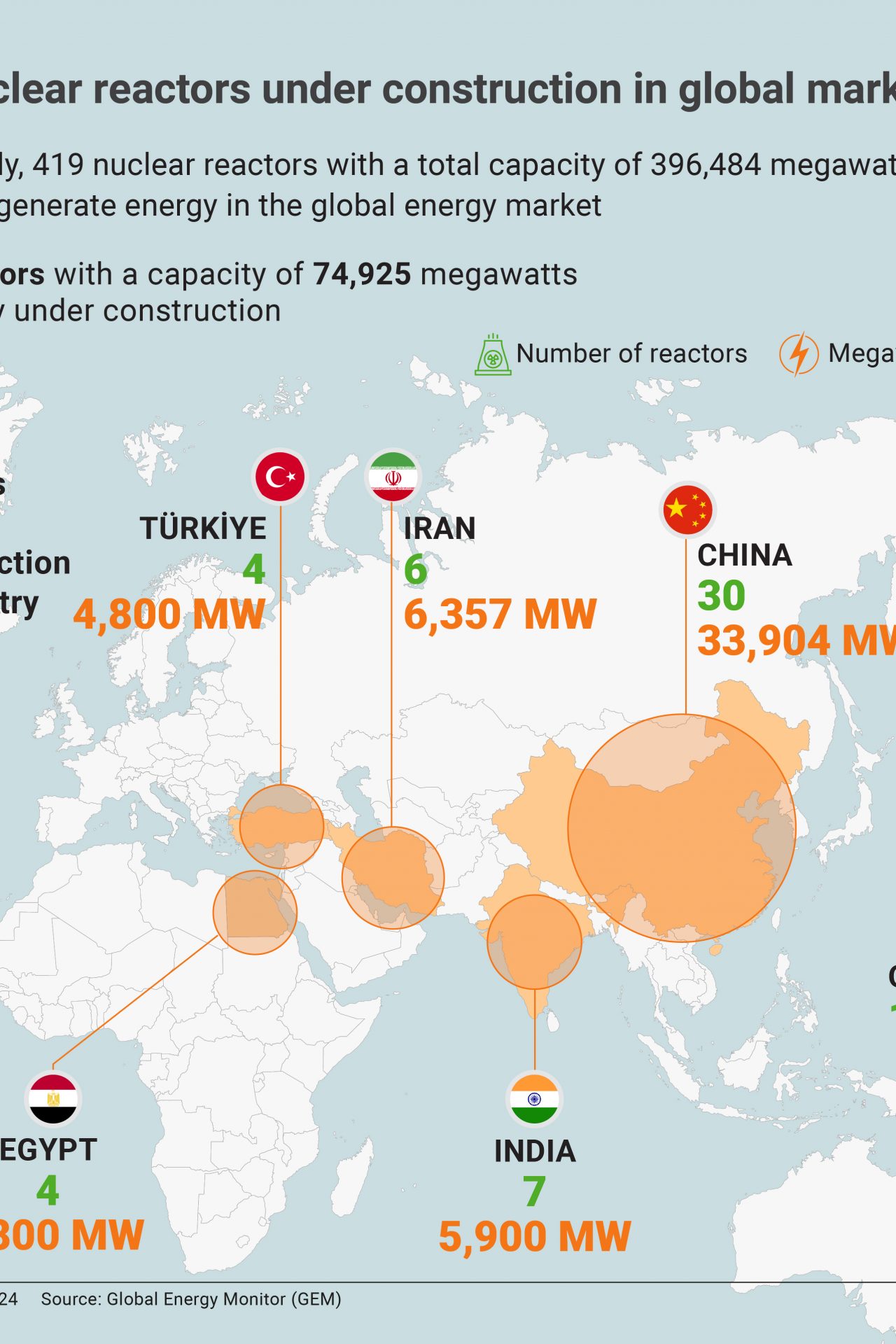

According to the World Nuclear Association, nuclear power accounts for roughly 9% of the world’s electricity via roughly 440 nuclear power plants. It also provides the world with one-quarter of its low-carbon power.

Nuclear energy is the world’s second-largest source of low-carbon power. More than 50 countries utilize nuclear energy and the amount of power that it generates is set to grow in the future thanks to recent global commitments.

In November 2024, BBC News reported that the 2024 United Nations Climate Change Conference COP29 focused on ramping up funding needed for new nuclear projects after a UN report that revealed current policies were failing to stem rising temperatures.

Aside from the growing demand that nuclear power will see in the future, uranium prices have hit new highs in recent years. Financial Times reported that January 2024 saw the price of uranium surge above $100 dollars a pound, a price not seen since 2008.

The price of uranium cooled to roughly 73$ dollars a pound but that has been far higher than the average price of $50 a pound over the last decade, and it's these rising prices that have Canadian energy firms interested in cashing in on the commodity.

Canada is particularly poised to profit from rising uranium prices thanks to, among other things, the nation’s Athabasca Region, which contains an unusually large amount of high-grade uranium according to McMaster University professor Markus Piro.

Piro told BBC News Canada was a “tier-one nuclear nation” because of its ability to mine, refine, enrich (in some cases), and ship its product around the world. “We’ve got a one-stop shop here in Canada, not every nation’s like that,” Piro explained.

Canada is also the second-largest producer of uranium and accounts for about 13% of the world’s total global output according to stats from the Canadian government published by BBC News. However, that doesn’t mean there isn’t room to grow.

Canadian energy company NexGen is working on developing the largest uranium mine in the country. If it passes regulation it will boost Canada’s share of total global output to 25%. But there are other players in the game.

Cameco, which has been mining uranium in Canada since 1988 currently supplies 30 nuclear reactors around the world and recently reopened two of its mines in late 2022 to help boost uranium output

“Canada could be a nuclear superpower around the world,” Cameco CEO Tim Gitzel told the BBC News, and he wasn’t wrong. Financial Times pointed out at least 31 countries want to triple their deployment of nuclear energy by 2050.

Canadian Minister of Energy and Natural Resources Jonathan Wilkinson told Financial Times that investment in the country’s uranium production has reached a 20-year high, especially when it comes to exploration and deposit appraisals.

Investments have surged “by 90 percent to C$232mn [US$160mn) in 2022, and an additional 26 percent in 2023 to C$300mn,” Wilkinson explained, making Canada particularly poised to capitalize on the growing global demand for uranium.

“Not only does Canada mine enough uranium to fuel our domestic reactors, but we are also the only country in the G7 that can supply uranium to fuel our allies’ reactors,” the minister said. “Each year, Canada exports over 80 percent of our uranium production, making us a world leader in this market.”

More for you

Top Stories