The economic gap between Europe and the United States: myth or reality?

On both sides of the Atlantic, the press is reporting Europe's economic decline in relation to the United States. But is this really the case?

The United States recorded activity growth of 2.5% in 2023, compared to 0.5% for the European Union, notes the French media outlet L'Opinion, and the trend is expected to continue.

According to forecasts from the International Monetary Fund (IMF), cited by French newspaper Le Figaro , growth should reach 2.7% in the United States, compared to 1.1% in the EU and even 0.8% in the eurozone. For 2025, expectations remain slightly higher for the United States.

This discrepancy is part of the long term gap. According to World Bank data, cited by French newspaper Le Monde, American gross domestic product (GDP) was 30% higher than that of the euro zone in current dollars in 2010, and 87% in 2022.

Le Monde also cites a note from consultant McKinsey, which highlights that the average annual growth of GDP per capita was twice as high in the United States (1.7%) as in the European Union (0.8%). ).

A study by the European Center for International Political Economy, published in July 2023, compared the GDP per capita of European countries with those of American states taken individually.

While the countries of southern and eastern Europe all came in behind the poorest federal state, Mississippi, France came in between Idaho ( 48th out of 50) and Arkansas ( 49th ), and Germany between Oklahoma ( 38th ) and Maine ( 39th ).

Supported by the strength of its technology companies, by the Biden administration's recovery plans and by its energy independence, the United States is asserting itself more than ever as the world's leading economic power.

Furthermore, the boom in global military spending since the start of the war in Ukraine benefits the United States more, because many countries prioritize getting their supplies from the US which is also the leading military power in the world.

Conversely, Europe appears handicapped by structural factors, such as the aging of its population, the investment deficit, energy dependence and regulatory constraints without equivalent in the world.

In 2023, the Wall Street Journal cited “an aging population that prefers free time and job security to income” to explain European decline. Do the inhabitants of the Old Continent have a preference for leisure activities?

For economist Patrick Artus, of the Natixis bank, the issue of productivity is central to explaining the European dropout: productivity per capita increased by more than 20% in the United States between 2010 and 2024, compared to around 5% for the euro zone over the same period.

The expert also notes that investment in research and development (R&D) is higher in the United States over the entire period. In 2022, for example, it amounted to almost 3.5% in the United States, compared to just under 2.3% in the eurozone.

Whatever the case, successive shocks (financial crisis of 2008, Covid-19 pandemic, energy and purchasing power crisis linked to the war in Ukraine) have left deeper scars in the old world than in new.

Europe's economic locomotive, Germany is mired in an energy crisis linked to the simultaneous exit from nuclear power and Russian gas, while its industry is hit hard by Chinese competition.

The country experienced a slight recession in 2023, with negative consequences across the continent. And the outlook hardly any better for the current year.

However, the variation in the exchange rate between the euro and the dollar must put into perspective the idea of a massive and growing gap between the two Western economic blocs.

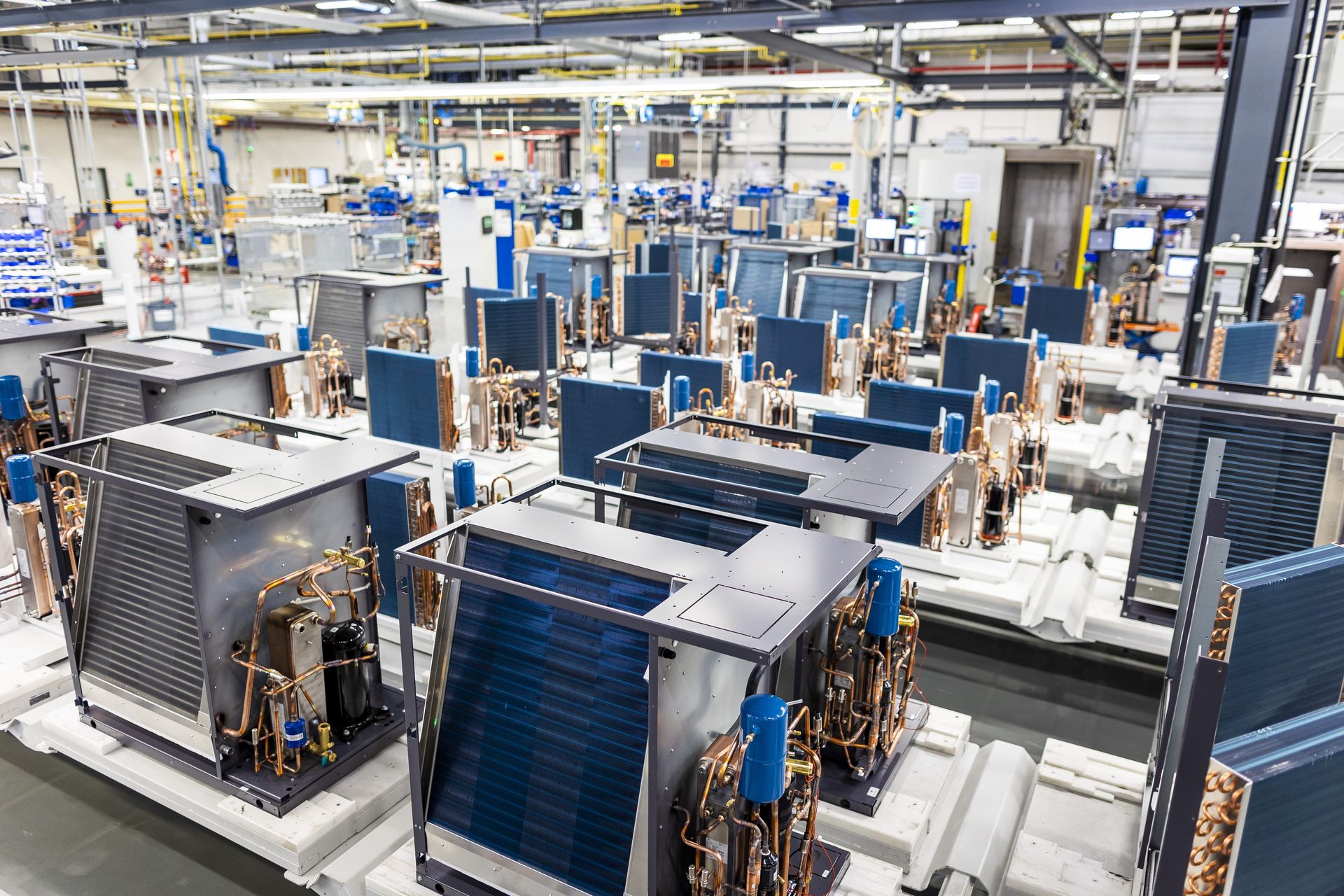

Photo: JustStartInvesting / Unsplash

A study by the European Bruegel Institute recalls that the EU's GDP was a third lower than that of the United States in 2000, then slightly higher in 2008 and again lower by a third in 2022. How to explain such variations which do not reflect those of the activity?

The answer is simple: the euro was worth 0.92 dollars in 2000, then 1.47 in 2008 before falling to 1.05 dollars in 2022. Price variations therefore partly (but not entirely) explain the advance displayed by the American economy.

Expressed in purchasing power parity (by neutralizing variations in the exchange rate), the gap between the two economies appears much more limited, with GDP per capita falling from an identical level in 2000 to 4% less for EU in 2022.

Likewise, the acceleration in American productivity can be explained by the greater number of hours worked in this country. Because, as the Bruegel Institute notes, productivity per hour worked was equivalent in France, the United States and Germany in 2022.

“Some countries in the west and north of the European Union are at least as productive as the United States in terms of output per hour worked, but Europeans seem to prefer leisure to income,” concludes this institute, whose Works are cited by Slate.

This discrepancy more generally raises the question of the desirable economic model for our societies: should we move towards ever more growth through work, or favor a more sober life and sacrifice purchasing power to adapt to current ecological imperatives?

More for you

Top Stories