BRICS countries will see the highest surge in millionaires globally over the next decade

The BRICS group of emerging economies is about to see an 85% surge in millionaire count over the next decade, far exceeding any other group of nations, according to a report by Henley & Partners.

Photo: Ragavan Moonsamy, a South African self-made millionaire.

“The 85% forecast for BRICS will be the highest wealth growth of any bloc or region globally,” Andrew Amolis, wealth analyst at New World Wealth told CNBC.

Photo: Unsplash/Ibrahim Mushan

In comparison, the G7 countries (Canada, France, Japan, Italy, the US, UK and EU) who held $110 trillion in investable wealth as of December 2023, are expected to see the number of millionaires in the region increase by 45% over the next decade, data provided by Amolis showed.

Tired of the West’s global domination, some of the world’s leading emerging economies, namely Brazil, Russia, India, China and South Africa, who make up the acronym, came together in 2009 to form BRICS.

At the beginning of 2024, Iran, Saudi Arabia, Egypt, Argentina, the United Arab Emirates and Ethiopia joined the current five members, they announced at the summit.

In the photo, Brazilian president ,Lula, and Iranian president Raisi.

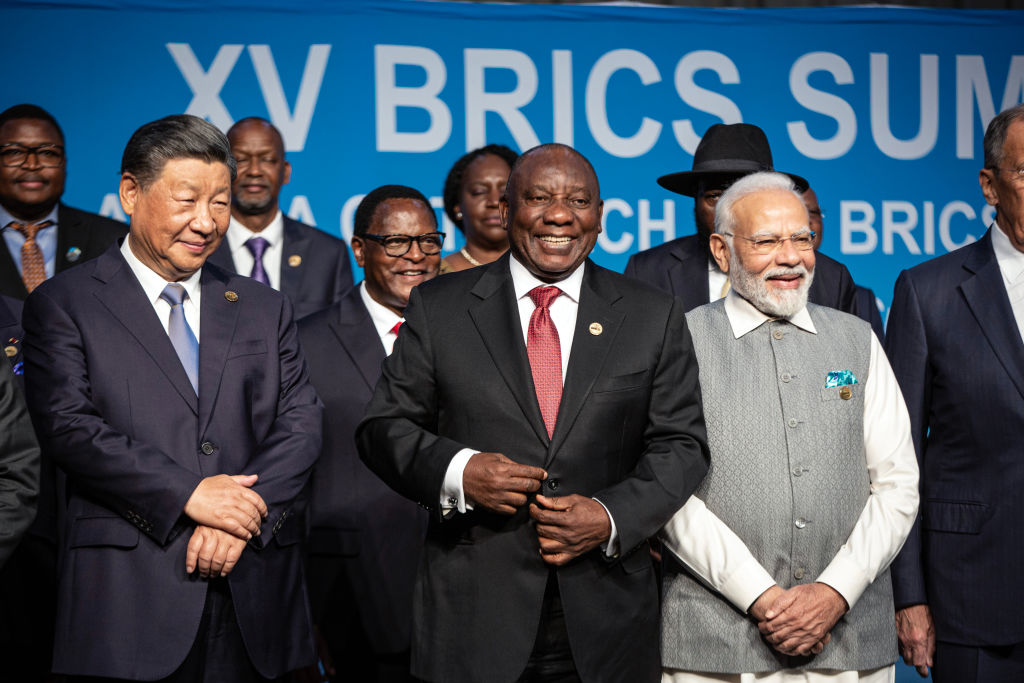

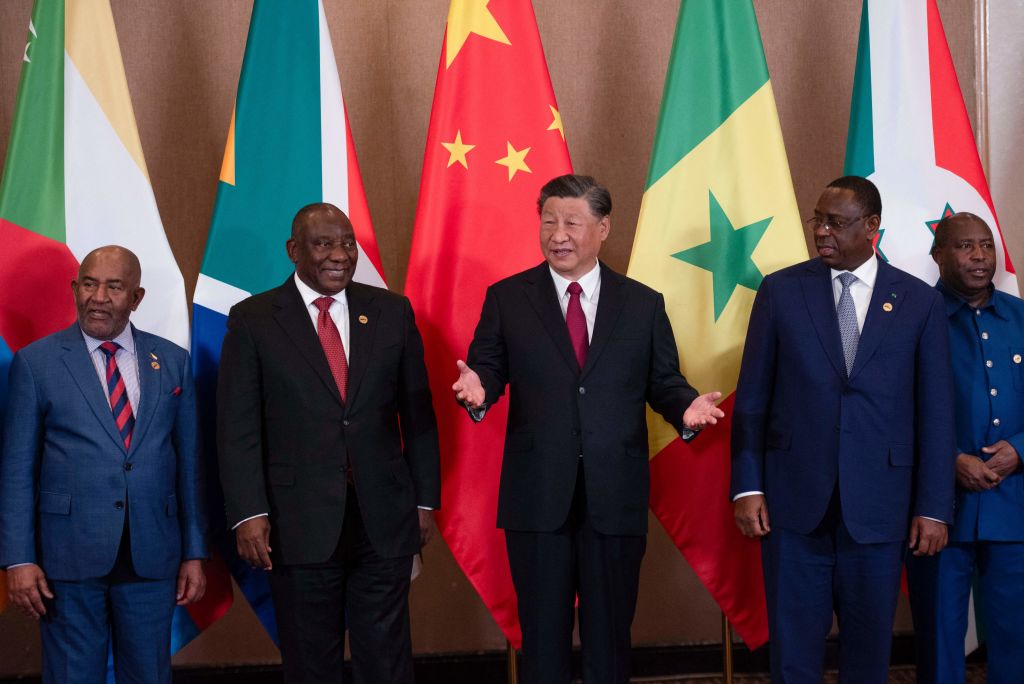

The host, South African President Cyril Ramaphosa (pictured), made the announcement and added that more countries will join in the future, the BBC reported.

Steve Tsang, director of London's Soas China Institute, told the BBC that President Xi was trying to show his fellow bloc members that though they may not have a lot in common, none of them want to live in a Western-dominated world.

"What the Chinese are offering is an alternative world order for which autocrats can feel safe and secure in their own countries," said Prof Tsang to the BBC.

"They can find an alternative direction of development without having to accept the conditionalities imposed by the democratic Americans and European powers," Tsang added.

For China and Russia, specially, BRICS expansion is “a win”, said Ryan Berg, the head of the Americas programme at the Centre for Strategic and International Studies to The Guardian.

“For China, it allows them to continue to build what they hope is a Beijing-centric order. For Russia, who is hosting it in 2024, it sees this as a tremendous opportunity in its current moment of significant isolation,” Berg explained.

In 2022, Western sanctions over Russian’s invasion of Ukraine froze nearly half of Russia’s foreign currency reserves. On the other hand, the US imposed restrictions on exports of semiconductor technology in China.

Furthermore, major Russian banks were removed from SWIFT, the messaging network banks use to facilitate international payments.

“As the US weaponizes the dollar in the Russian and Iran sanctions, there is increasing desire by other developing countries to come up with an alternative multilateral clearance system outside of SWIFT,” Shirley Ze Yu, a senior economist, told Al Jazeera.

Russian President Vladmir Putin, who joined last year’s summit by video link from Russia because of the danger of being arrested over war crimes in Ukraine, talked about a “de-dollarisation”.

Moreover, analysts say the dollar will remain king for the foreseeable future. Chris Weafer, an investment analyst that focuses on Russia and Eurasia, told Al Jazeera, we are still “decades” away from anything really challenging its dominance.

Photo: Frederick Warren/Unsplash

“With these new members, especially the major oil producing ones, on board, the BRICS configuration represents a much more significant share of the global economy and global population,” Myers argued.

More for you

Top Stories