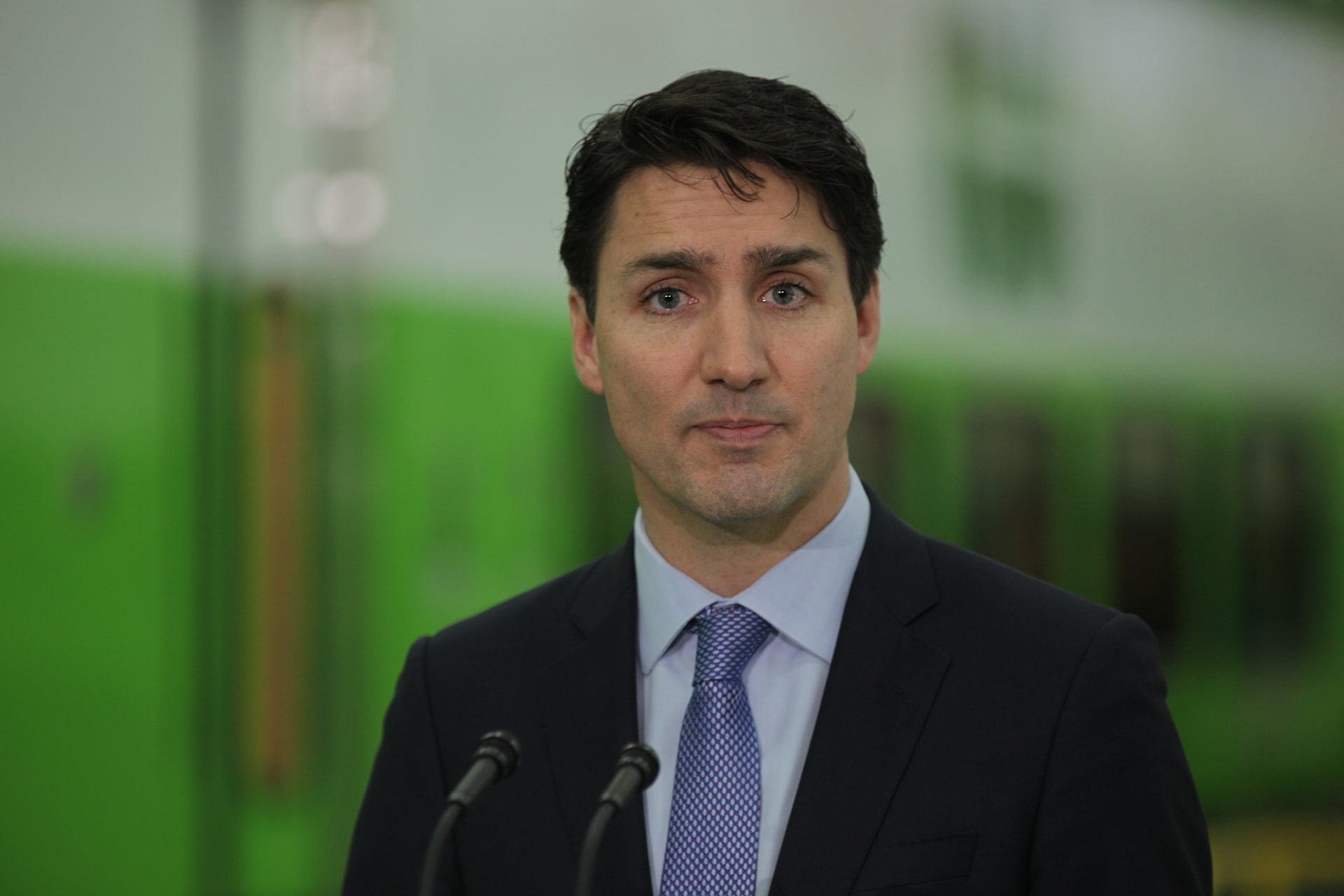

Canadians are unhappy with their government's new budget

On April 16th, Justin Trudeau’s government released its budget for 2024 and it was met with praise and disdain from both sides of the political aisle. However, Canadians aren’t too keen on the new budget based on recent polling.

Budget 2024: Fairness for Every Generation as Ottawa entitled the policy was designed to level the playing field among Canada’s various classes but the proposal has very little to offer Canadians according to columnist Andrew Coyne.

Writing in The Globe and Mail, Coyne noted that the 2024 budget revealed Ottawa had no priorities or anchors when it came to economic growth. What is offered in the budget is a focus on housing, taxes, students, and green energy policy.

The federal government will spend $8.5 billion to unlock 3.87 million homes in Canada by 2031 so that it can ensure every Canadian will be able to “find an affordable place to call home” according to the government’s budget highlights section on its website.

CP24 reported in its breakdown of the government’s budget that housing amortization periods will be extended to thirty years for first-time home buyers and builders will be given larger tax incentives to kickstart housing projects.

A new capital gains tax on high-net-worth individuals, corporations, and trusts will also help to level the playing field for Canadians. The inclusion rate will jump up from 50% to 66% on capital gains over $250,000, which will yield $19.4 in tax revenue.

Students can expect millions in loan forgiveness for those in both health and education as well as hygienists, pharmacists, teachers, social workers, and even early childhood educators according to CP24’s analysis of the budget’s key details.

More than $900 million will be invested over six years to help develop greener homes and foster other energy efficiency programs. Businesses will also be given a wealth of tax credits for a variety of clean energy policy incentives.

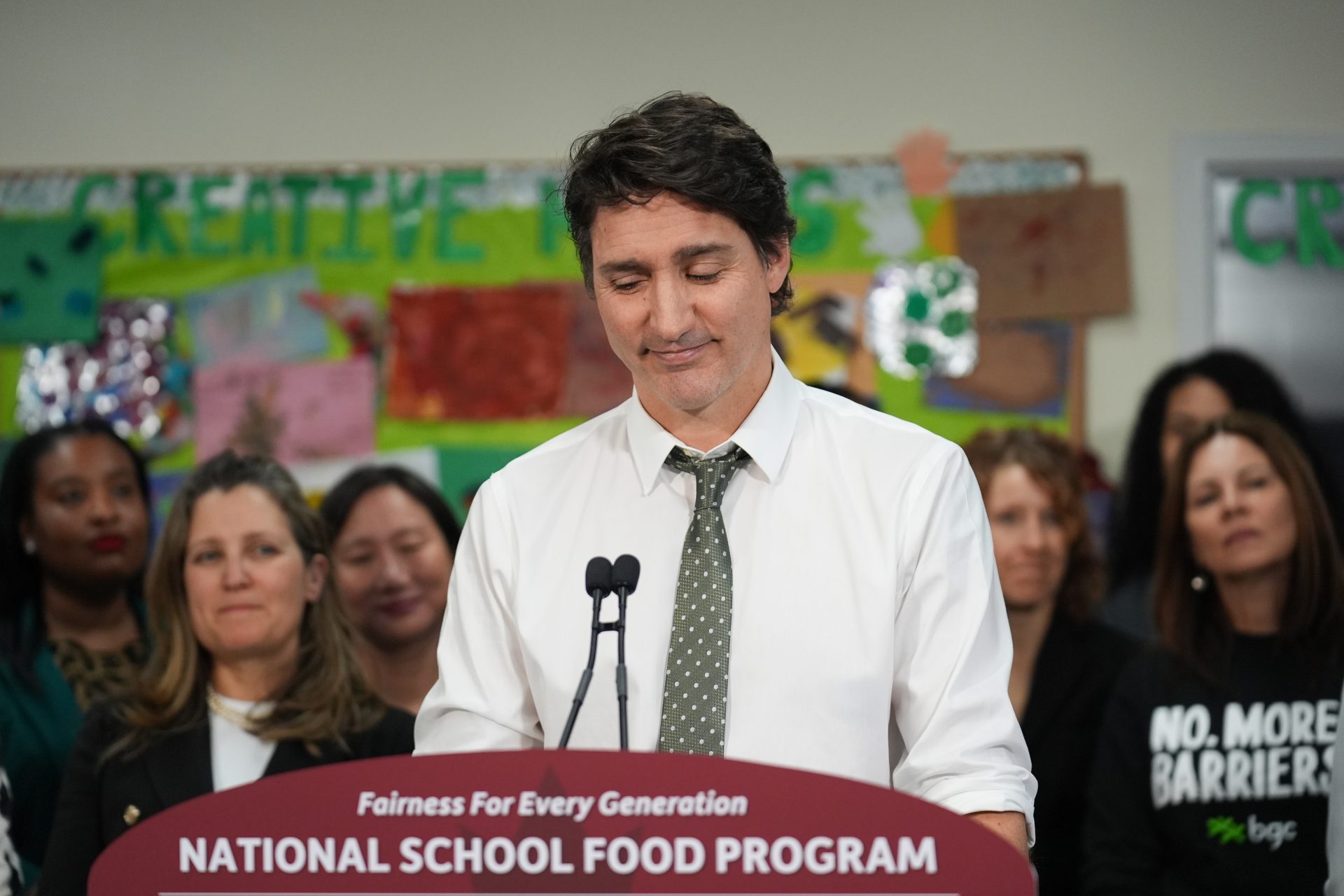

CBC News also reported several highlights it believed were important, which included $6 billion for the Canada Disability Benefit, $1 billion for the national food program, and $500 million for youth mental health programs.

However, the real key takeaways from the budget are that Ottawa will spend more than it planned with the government looking to shell out a total of $52.9 billion extra over the next five years. The cost to service the country’s national debt will also grow to $2 billion.

While the highlighted policies were designed to impress Canadians, the measures look like they have fallen flat with the country’s citizens according to polling from the market research Leger—which found 49% of Canadians saw the budget as negative.

However, Canadians did appear to like two aspects of the government budget. First, a majority of those surveyed (65%) noted the $8.5 billion dollar investment into housing aimed at unlocking millions of homes was a “good” thing for Canada.

Support for the new housing investments by the federal government was strongest in Quebec where 72% of respondents saw the measures as a good thing whereas only 56% of Albertans saw the measure as good—which was the lowest of all provinces.

The second budget initiative that was viewed as a good thing for Canada was the $900 million dollar investment into greener homes and energy policy, 64% of Canadians liked the measure. However, that figure fell to just 51% for Albertans.

A majority of Canadians (56%) also appeared to believe an increase in the capital gains tax would be good for the country while 53% noted that forgiving student loans would be a good initiative for Canada. But it is important to note people were worried about costs.

“Within a five-year outlook, almost half of Canadians (47%) think the government should cut back on spending and make different cuts in programs to come back to a balanced budget as quickly as possible,” Leger explained in a report on its polling.

More for you

Top Stories