NFTs made simple: a quick guide

Everyone is talking about NFTs these days it seems but some of us don't really understand what all the fuss is about. A common joke about NFTs is that they mix what you don't know about money with what you don't know about computers. Here's a quick guide, so that you don't feel out of the loop.

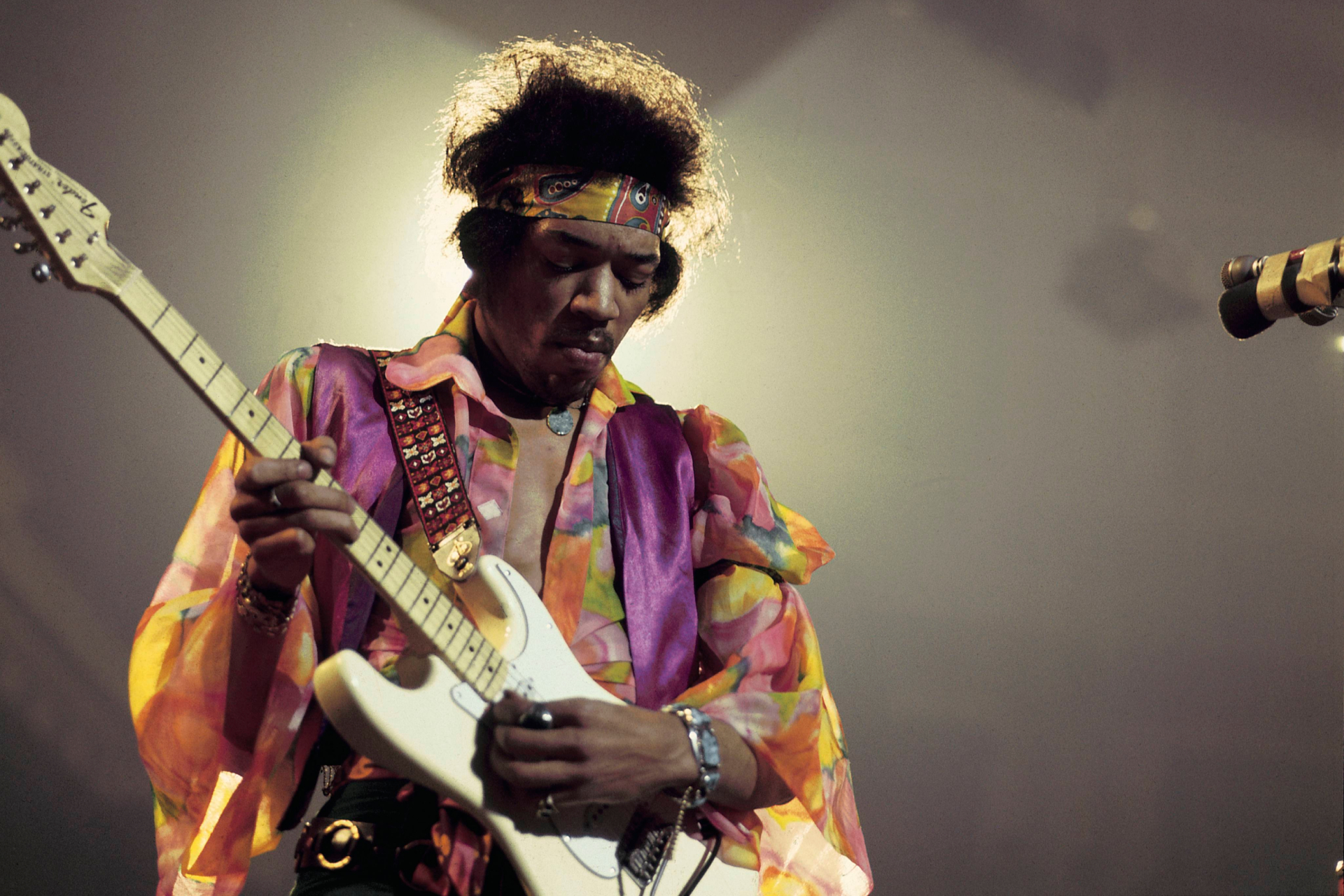

Image: Choong Deng Xiang / Unsplash

Let's start from the beginning. NFTs (Non-Fungible Tokens) are one of the latest trends in the world of technology and finances. But what does NFT actually stands for?

The 'Token' part of NFTs means that they are an asset that can be bought, sold, or traded. It can be a digital file, such as an image, an audio recording, a text document, etc. In this instance, virtually anything can be 'tokenized', however, here comes the tricky part…

These assets or tokens are non-fungible, thanks to blockchain technology. In layman's terms, the technology behind cryptocurrency ensures that a digital file has a code that makes it unique.

This means that, unlike a photo or text file that you copy and share through e-mail or WhatsApp, you can't duplicate NFTs. Also, unlike cryptocurrencies, you can't swap an NFT for another NFT. They are one-of-a-kind and therefore have a unique value.

Since NFTs are unique and exclusive, they can be a useful tool for digital artists to preserve the exclusivity of their work. However, it also makes way for speculation.

After all, anything exclusive has a unique value attached to it that depends on how much are people willing to pay for it. The image of this GIF, called Nyan Cat, was sold in February 2021 for over 580,000 US dollars. Business Insider called it an example of Crypto Art.

Some digital creators have started to focus on exclusively working Crypto Art. The NFT of a digital collage by US artist Beeple was sold at Christie's for over 69 million US dollars in March 2021.

Pictured: Works by Beeple exhibited at a crypto art museum in Beijing.

As explained before, not all NFTs have to be “art”. In December 2021, Christie's auctioned the first online version of Wikipedia for 750,000 US dollars. The argument behind the sale was that the owner was acquiring a piece of internet history.

This begs the question: are all NFTs valuable? Well, it depends. Going back to the art analogy, a painting, or a sculpture only has a worth fixed by the market. Graffiti art by Banksy has sold for millions.

The same thing happens with NFTs. For example, Lindsay Lohan has recently launched a series of NFTs for sale. If people are willing to pay something, they might be valuable. If not, they might be deader than disco.

However, some analysts believe that NFTs (and cryptocurrencies) are nothing but a speculative bubble that could burst at any minute. Instead of being a novel way to trade art, they are no different from the Tulip Mania that hit the Dutch economy in the 17th century.

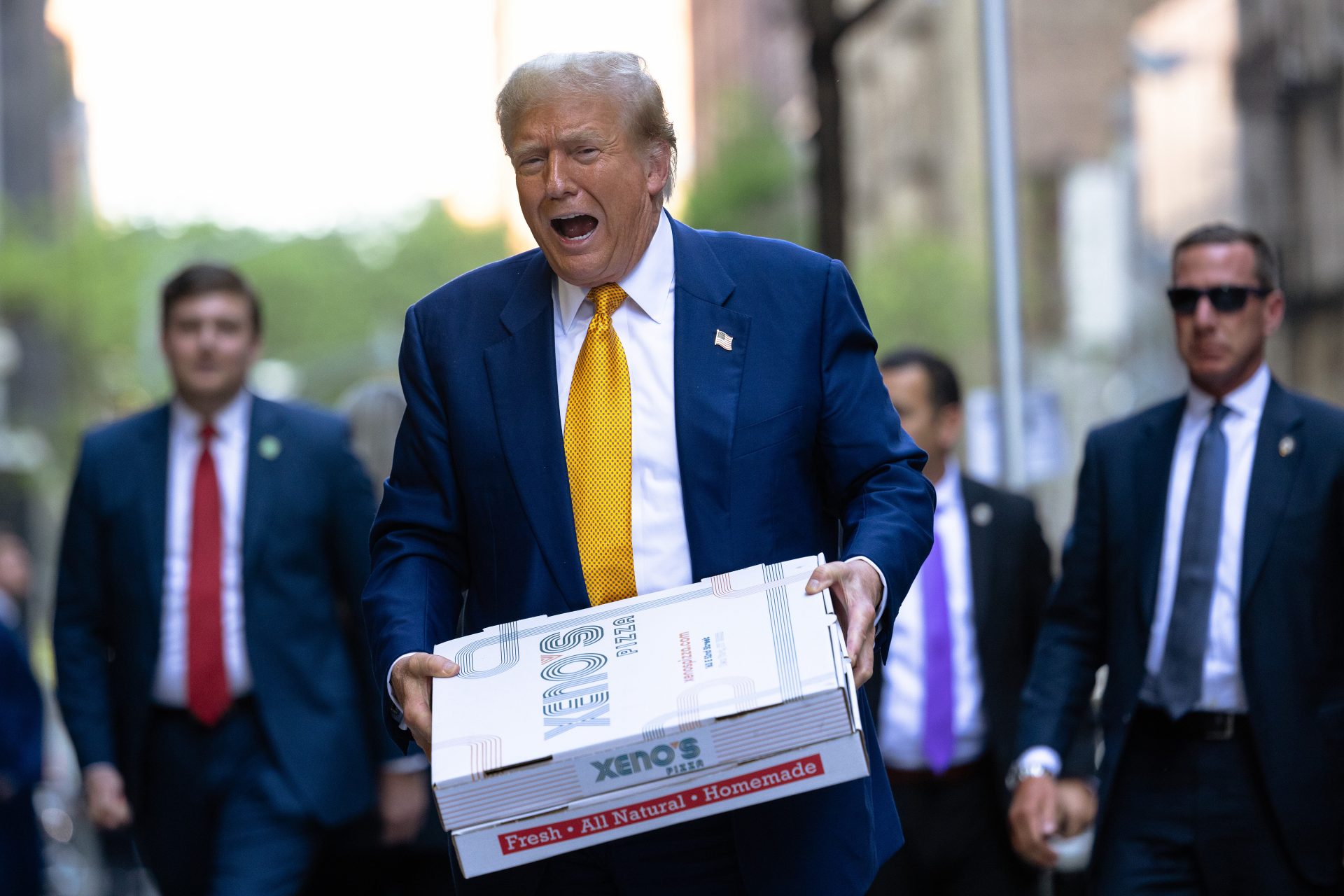

Image: Catia Climovich / Unsplash

"There’s virtually nothing humans can’t turn into a market". Writes Australian economist John Hawkins in The Conversation. In his piece, he argues that NFTs are essentially a Ponzi scheme where the only way to profit is finding a "bigger fool" to buy your assets.

“There are speculative bubbles in things with absolutely no fundamental value. NFTs have joined Bitcoin as examples of tokens with no intrinsic worth, which speculators just buy in the hope the price will keep rising,” writes Hawkins.

Regardless of whether NFTs are a solid investment, a Ponzi scheme, or an economic bubble, what is true is that many are jumping on the bandwagon. Eccentric artist Damien Hirst launched a collection of 10,000 NFTs with an estimated value of 50 million US dollars.

From YouTube celebrities to TIME magazine are getting into the NFT business. Even Former US First Lady Melania Trump got around selling a painting of her eyes, according to CNN. However, the value had already sunk just after the auction.

Kevin Roose, a columnist for The New York Times, did an experiment. In March 2021, he decided to auction one of his columns in NFT form. It sold for 560,000 US dollars.

After the auction, Roose wrote an article titled “Why Did Someone Pay $560,000 for a Picture of My Column?” where he included opinions on NFTs. Artist Rulton Fyder argued that NFTs created a “new digital value system”.

“People from my generation who grow up in the 1970s will love to collect first edition books, novels such as Ulysses by James Joyce,” wrote the artist to The New York Times. “What crypto and NFT opened up is the ownership of the rights to say one owns such a thing, whether tangible or intangible.”

What is true is that tech industry moguls, like Mark Zuckerberg and his Metaverse, are betting on NFTs, just like they are doing with cryptocurrencies. As our reality turns more virtual, concepts such as assets or ownership become more fluid. Time will tell if this booms or busts.

More for you

Top Stories