Canadian and American companies are feeling the blow of Trump's latest tariffs

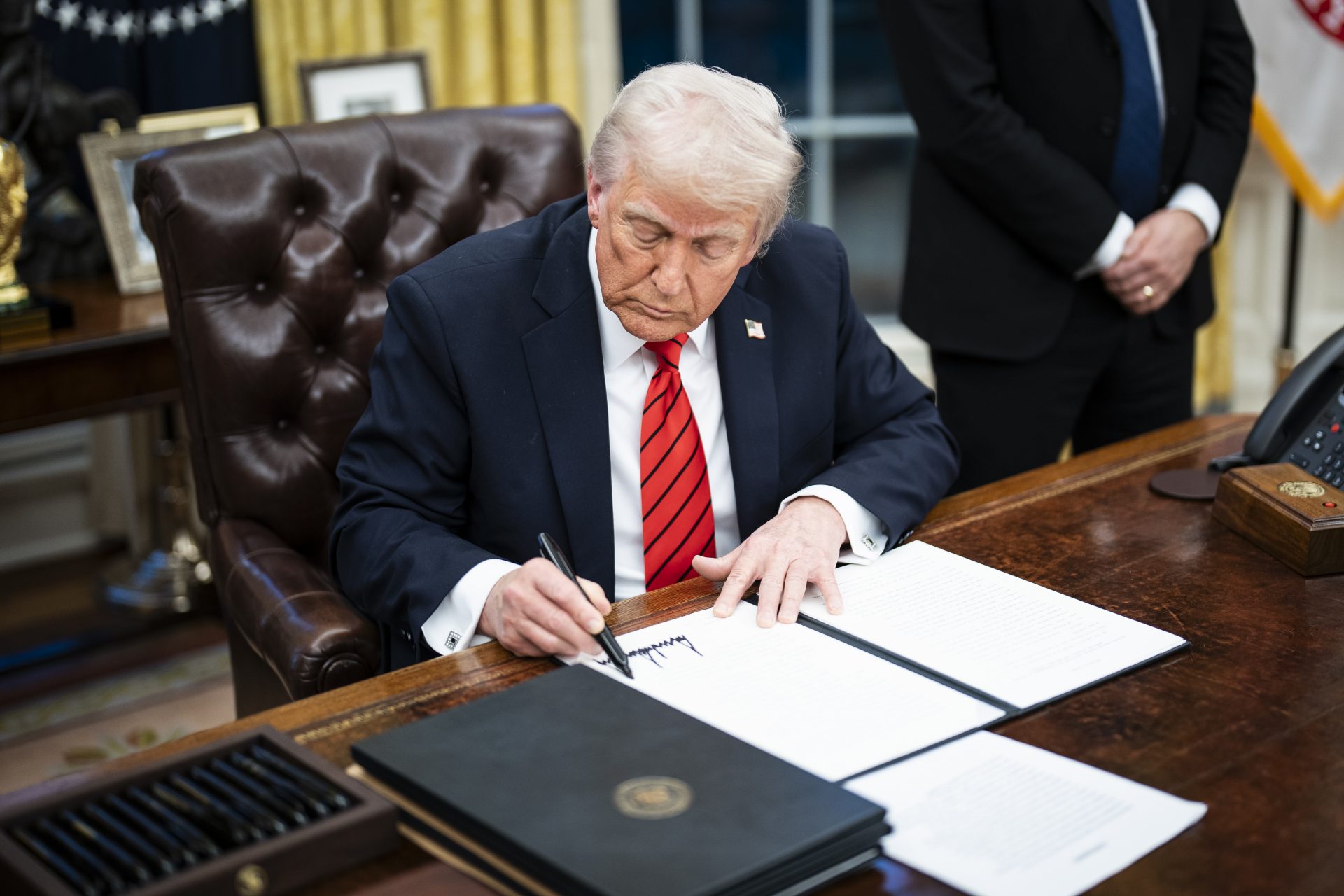

American and Canadian companies are already feeling the blow of Trump's 25% tariffs on steel and aluminum imports, the first product-specific duties of his new term.

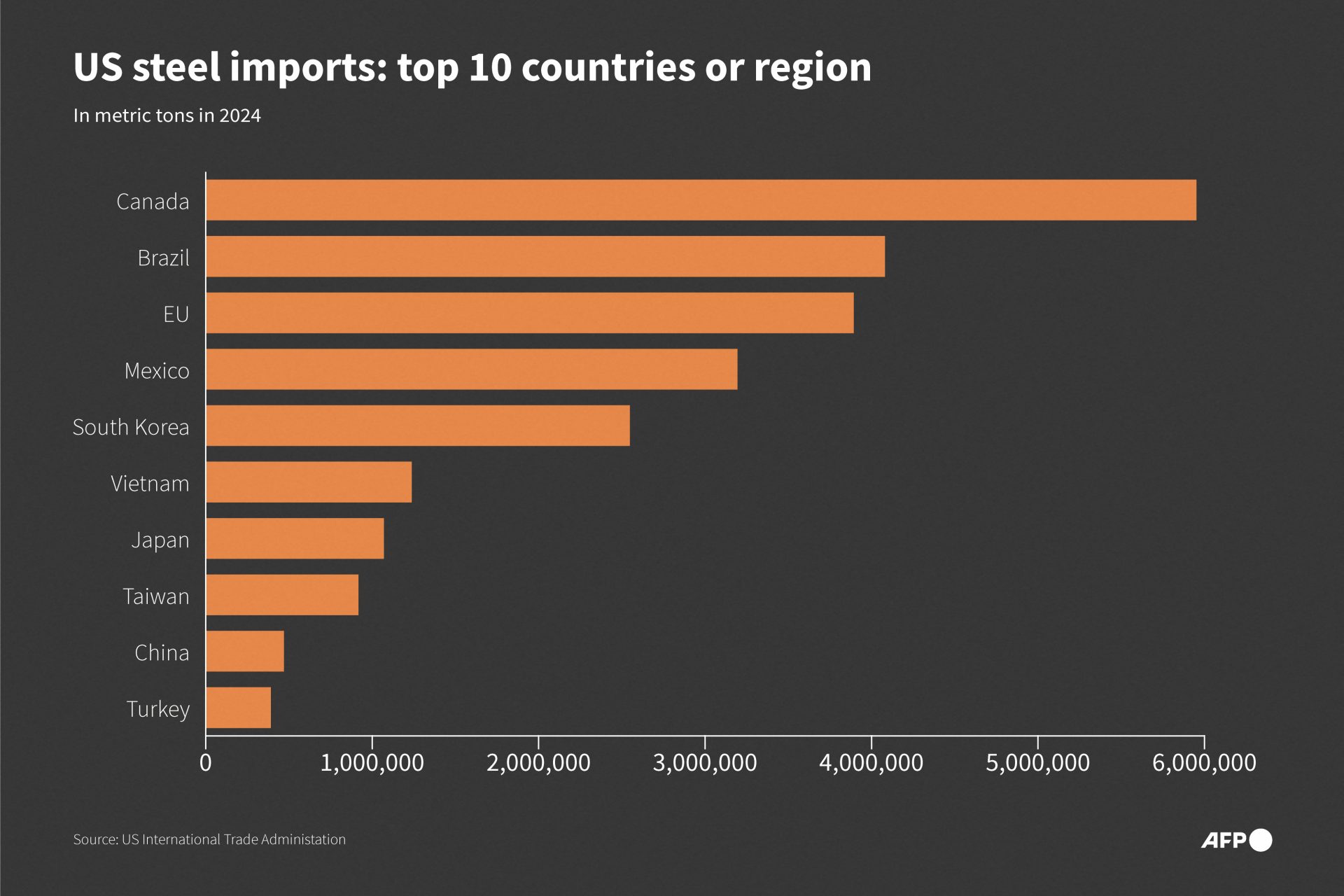

The import taxes will affect some of the US's closest trading partners. According to the Wall Street Journal, most of the country's metal imports come from Canada, Mexico, Europe, South Korea, and Japan.

So, companies with tight commercial relationships across the northern border already feel the heat and expect the duties to profoundly affect their businesses.

Canadian steel manufacturers and distributors told the CBC they expect a quarter of their US sales to fall. Canada is the first supplier of metals for several US manufacturers.

Some of those manufacturers pulled out orders even hours before President Trump signed the executive order. "It's extremely worrisome," Rahim Moloo of Toronto-based Conquest Steel told the CBC.

Experts agree that all tariffs are inflationary. They transfer the tax's costs to consumers. However, the specific aluminum and steel duties will affect the industry first.

Prices will increase for manufacturing companies that use steel and aluminum as raw materials, even if they switch to US-produced metals.

Trump officials used that argument to justify the new tariffs. According to the WSJ, they explained that the duties are strategic, not a negotiation tactic.

However, the strategy will not necessarily work, many business leaders pointed out while dealing with feelings of deja vu from the last time President Trump imposed similar tariffs.

He did so during his first term, arguing that it would boost domestic steel and aluminum production. In 2018, he placed a 25% tax on steel and a 10% tax on aluminum.

However, according to the WSJ editorial board, the tariffs did little to boost production, which was already growing under his tax cuts. They did, however, allow local producers to raise prices, which affected manufacturers.

After the pandemic, US aluminum and steel production declined. According to the newspaper, they fell back to 2016 levels before the tax cuts boosted production.

American producers supporting tariffs are blaming international competitors for the low prices and reduced production of the metals, but that is not accurate.

According to the WSJ, steel and aluminum are more expensive now. Steel prices are 50% higher than in 2019, and aluminum prices 30% higher.

The WSJ editorial board argues that the evident reason American steel and aluminum producers want tariffs is that they allow them to raise their bottom lines.

So, even if US manufacturers switch to local producers, they will likely pay higher prices. If the tax is 25%, local producers can boost their prices by up to 15% and still compete.

More for you

Top Stories