The most notorious pyramid schemes of all time

The namesake of the Ponzi scheme, Charles Ponzi, promised investors a 50% return within 90 days by profiting from international postal reply coupons. It all started when 18 people invested and were paid interest with the money from the next set of investors. It caught on like fire. Soon, this scheme cost his investors millions and collapsed spectacularly at the end of 1920.

But Ponzi schemes were happening long before Mr. Ponzi. Take this one, where in Munich, Adele Spitzeder founded a private bank promising a hefty 10% interest per month. Attracting a vast number of deposits, she became the wealthiest woman in the state, but her bank eventually collapsed, marking the largest case of fraud in 19th-century Bavaria.

Photo: Adele Spitzeder as a young actress, taken ca. 1852, Unknown author, Wikimedia

Ivar Kreuger, a Swedish businessman, built an empire on a Ponzi scheme centered around his match monopolies at the height of the roaring 20s. He promised investors substantial profits based on the supposed ever-expanding nature of his business, but the empire collapsed after he took his own life in 1932 and it emerged that the assets and profits in his business were largely made up.

Photo: Ivar Kreuger circa 1920, Unknown photographer, via Wikimedia

In Portugal, Dona Branca operated a scheme paying 10% monthly interest, primarily targeting the poor. She was revered as a benefactor and even called "the people's banker" until her arrest, when it was revealed she had amassed around €85 million ($92 million), exposing a massive Ponzi structure.

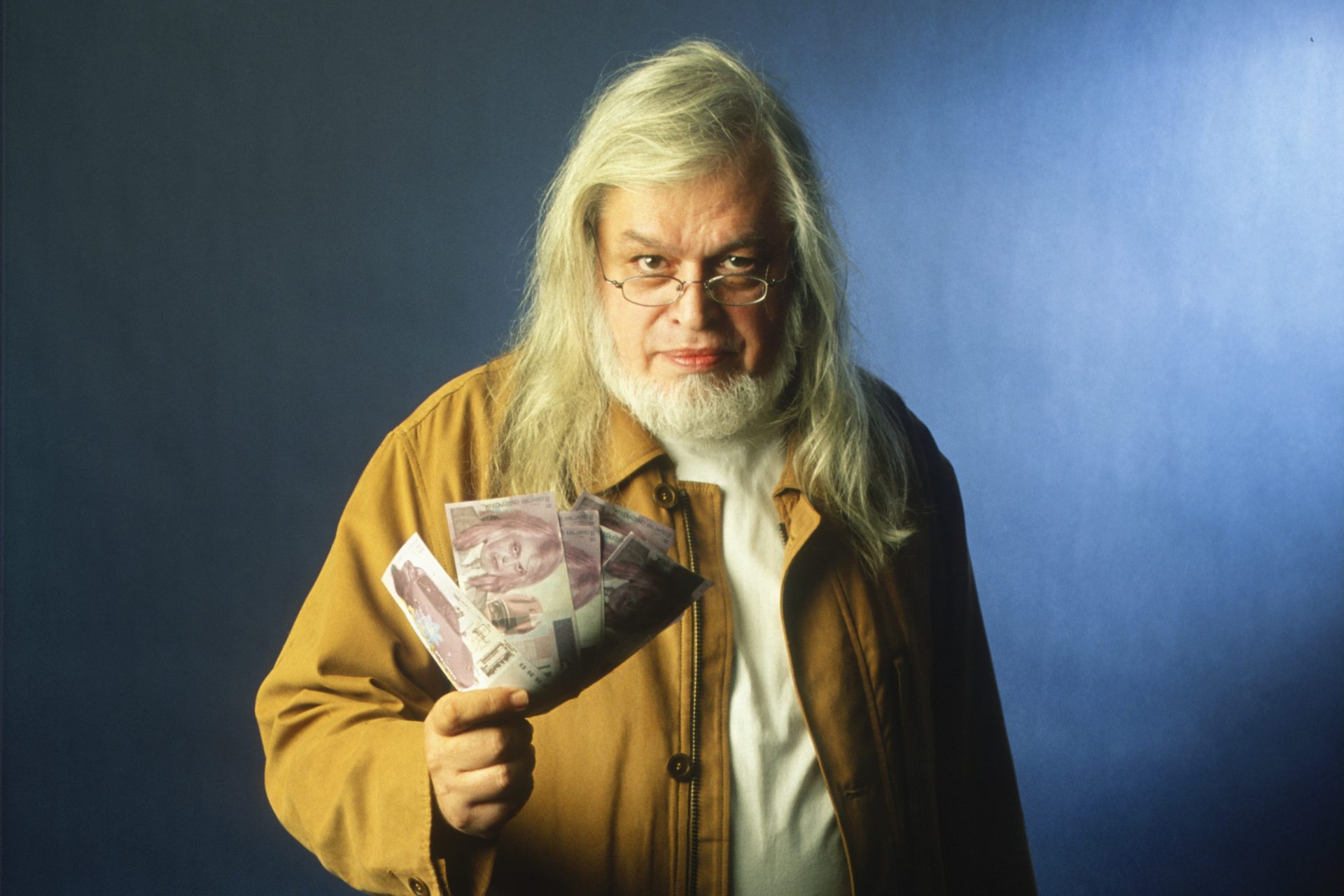

Image: A Banqueira do Povo, 1993/ RTP Archive (TV show based on the real-life events, translated as 'The People's Banker')

In Belgium, Van Rossem ran an investment company claiming he could beat the stock market with a statistical model. His charismatic self-promotion and grand promises enabled him to gather about $860 million, only to be revealed as a partial Ponzi scheme and fraud. He even got the the Belgian royal family! However, he eventually went to prison in 1991. After that, he founded a libertarian protest party and was elected to the Flemish Parliament.

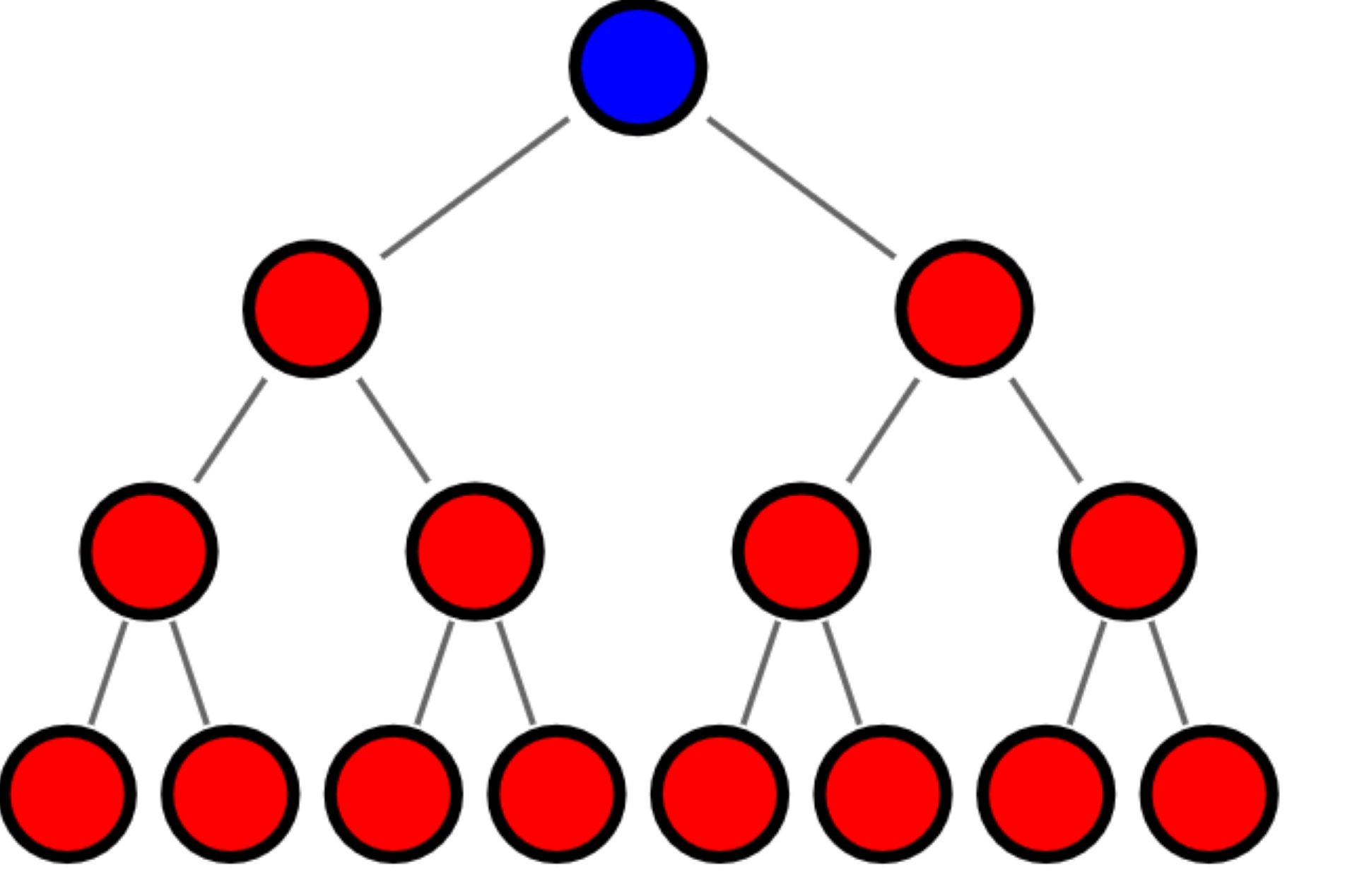

A textbook example of a pyramid scheme, the Airplane Game, which also went by other names, required new "passengers" to pay substantial sums to join, with promises that they would move up to "pilot" and receive large payouts. It spread widely before inevitably crashing. However, the scheme resurfaced in 2020 over social media platforms, especially in South Africa.

Image: Diagram of the "Airplane game" pyramid scheme / 28 March 2007/ Stannered via Wikimedia

A series of Ponzi schemes in Albania, many of which were run by the government itself, collapsed and prompted violent unrest across the country. An estimated two-thirds of the population lost money, leading to an almost total collapse of the economy and protests that escalated into a nationwide rebellion.

In Haiti, several "cooperatives" promised up to 15% interest rates and appeared government-backed, attracting wide public participation. They swindled investors out of more than $240 million, significantly impacting the national budget. As the New York Times reported, thousands of Haitians sold their cars, mortgaged their homes and emptied their savings to get in on the scheme.

Considered the largest financial fraud in U.S. history, Bernie Madoff's Ponzi scheme defrauded thousands of investors of approximately $65 billion. Madoff promised consistent returns to clients by using funds from newer investors to pay earlier ones and used political influence to stay afloat.

Allen Stanford was convicted of running a $7 billion Ponzi scheme, perhaps the second-lagest in US history, selling fraudulent certificates of deposits to tens of thousands of investors, promising improbably high returns. Unlike victims of the Madoff scheme, these customers told CNBC that they had recovered practically nothing.

Founded by Sergei Mavrodi in Russia, MMM was a major Ponzi scheme that promised annual returns of up to 3,000%. It defrauded millions of people out of billions before it was shut down. Estimates suggest up to 10 million people lost their savings. It made a comeback in 2011 as MMM Global as a "social financial network" and spread to several developing countries with less regulation, defrauding investors and being banned in other markets like China.

Originally started as an internet phone service company, TelexFree was revealed to be a global $3 billion pyramid scheme, one of the largest frauds of all time. It required participants to post online ads for a telecom service that barely existed. Over 1 million people were defrauded.

Photo: A victim speaks to her lawyer

A $900 million online Ponzi scheme disguised as a penny auction website, Zeek Rewards involved over 1 million users globally. Participants were paid profits from money invested by new recruits rather than from any actual business profits. Its former CEO Paul Burks was sentenced to 14 years in prison.

Image: Snapshot of ZeekRewards.com/May 4, 2011/Via Wayback Machine

This alleged $1.2 billion Ponzi scheme run by Robert H. Shapiro involved promising high returns from loans to commercial property owners. It targeted over 8,400 investors, many of whom were elderly, leading to a significant legal and financial fallout after its bankruptcy filing.

Yep, new technological advances and crypto-mania have made way for a new kind of pyramid scheme. This high-profile "open-source crypto" Ponzi scheme collapsed after regulatory warnings. Promising up to 40% monthly returns through a purportedly proprietary trading algorithm, Bitconnect left thousands of people with worthless tokens, whose value plummeted to below $1 from a high of nearly $525.

Marketed as a cryptocurrency, OneCoin was actually a centralized pyramid scheme. Its founder, Ruja Ignatova, disappeared, leaving thousands defrauded, with losses in the billions and significant ongoing legal repercussions. US prosecutors have alleged that the scheme has brought in around $4 million worldwide. Bulgarian-born Ignatova is one of the most-wanted people in the world and is still thought to be on the run.

Image: FBI Most Wanted poster

More for you

Top Stories